Nudge

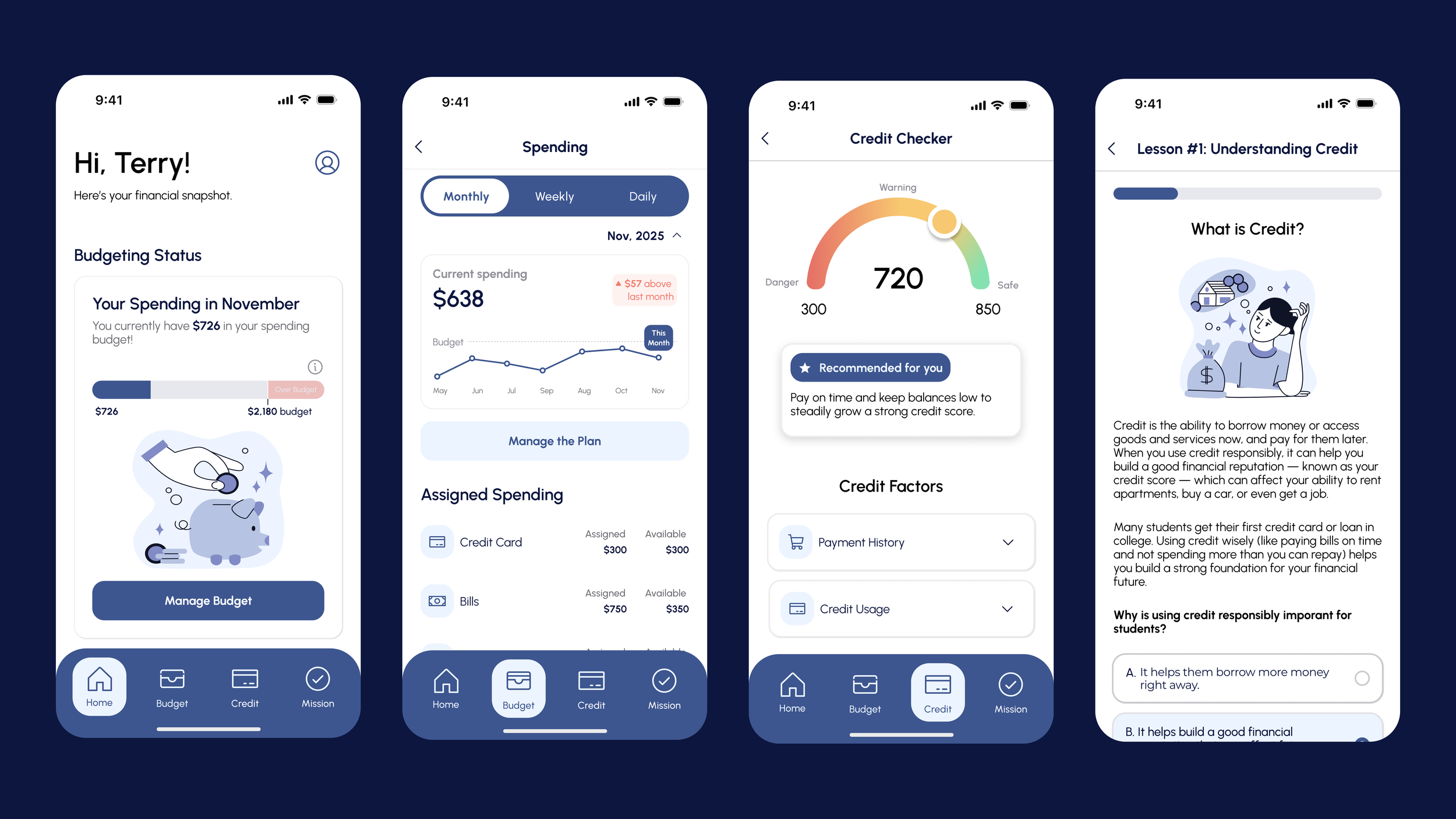

Nudge helps college students manage their flexible financial lives through budget tracking, credit monitoring, and gamified financial literacy lessons. Designed for a demographic balancing irregular income, student loans, and newfound financial independence.

Role: Onboarding Design, UX Research, Collaboration

Tools: Figma, Figjam, Miro

Timeline: 4 weeks, Fall 2025

Deliverables: Mobile app prototype, usability testing insights

Phase: Research → Wireframes → Usability Testing → High-Fidelity Design

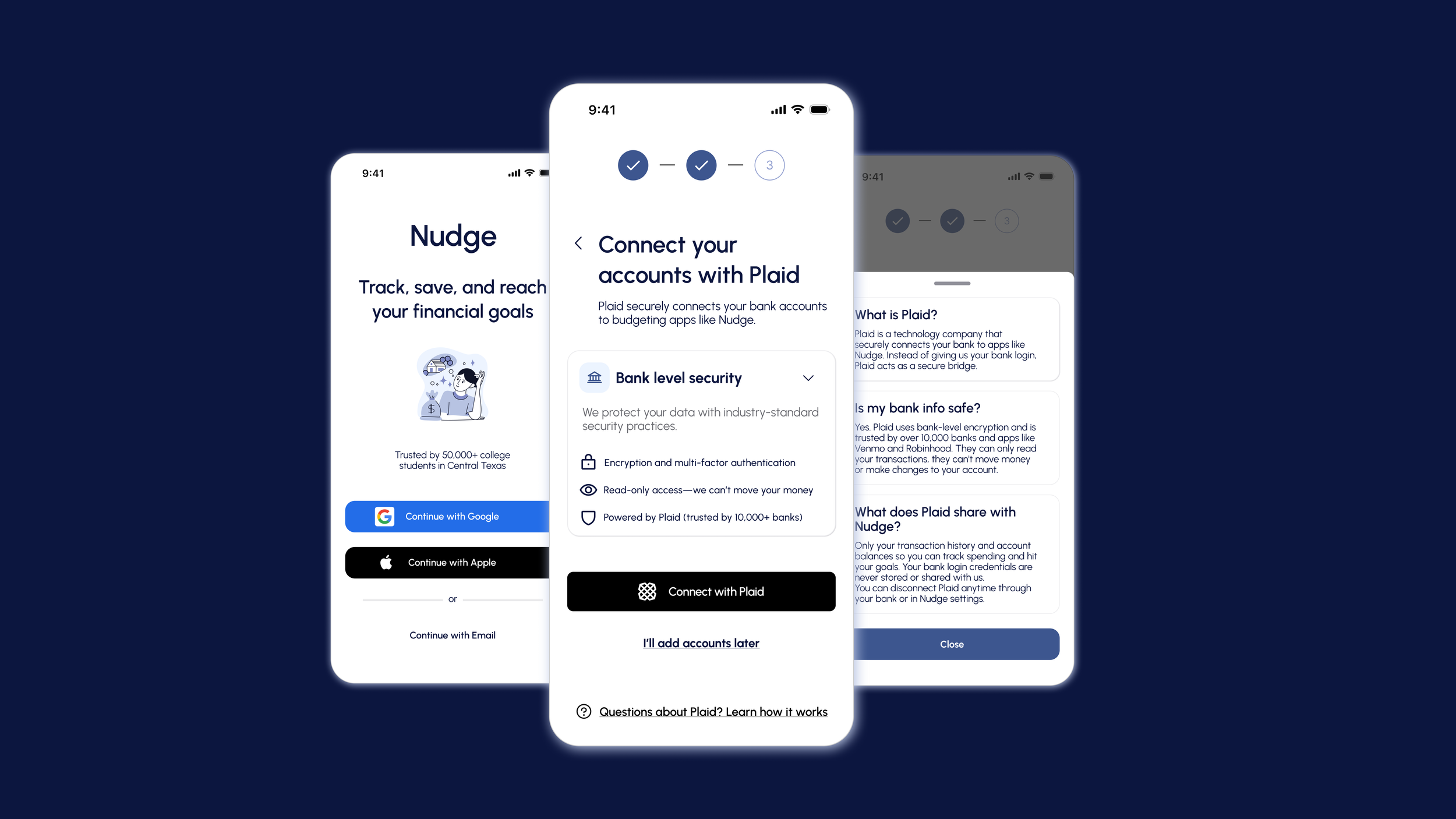

Our initial research with a competitor’s app revealed a critical onboarding challenge: users felt anxious linking their bank accounts, viewing Plaid as unfamiliar and potentially unsafe. I designed a solution that addressed this barrier through progressive disclosure and educational content.

The Onboarding Challenge

To understand the fintech landscape for college students, our team conducted a competitor analysis and usability testing on Rocket Money, a leading budgeting app. This research revealed several critical friction points in the user journey.

Security Issues

Users felt anxious about entering sensitive banking information into an unfamiliar app. While Rocket Money made it clear it was required to link a bank account, there was key information missing to make users feel more comfortable linking their accounts.

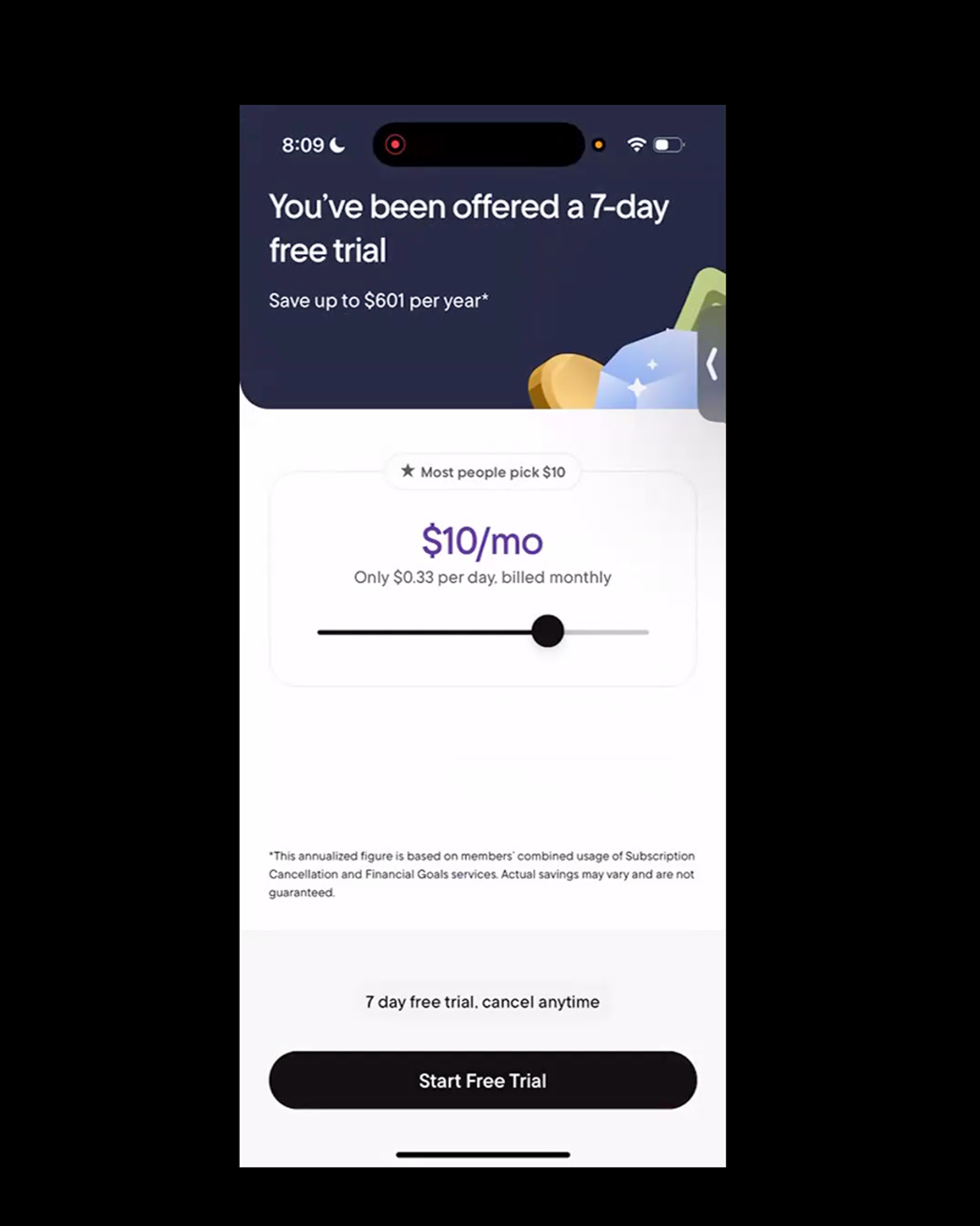

Dark Patterns

The paywall appeared multiple times and misled users into thinking subscription was required to access the most basic features of the app. With no visibly clear escape hatch, users felt like they were stuck subscribing to Rocket Money.

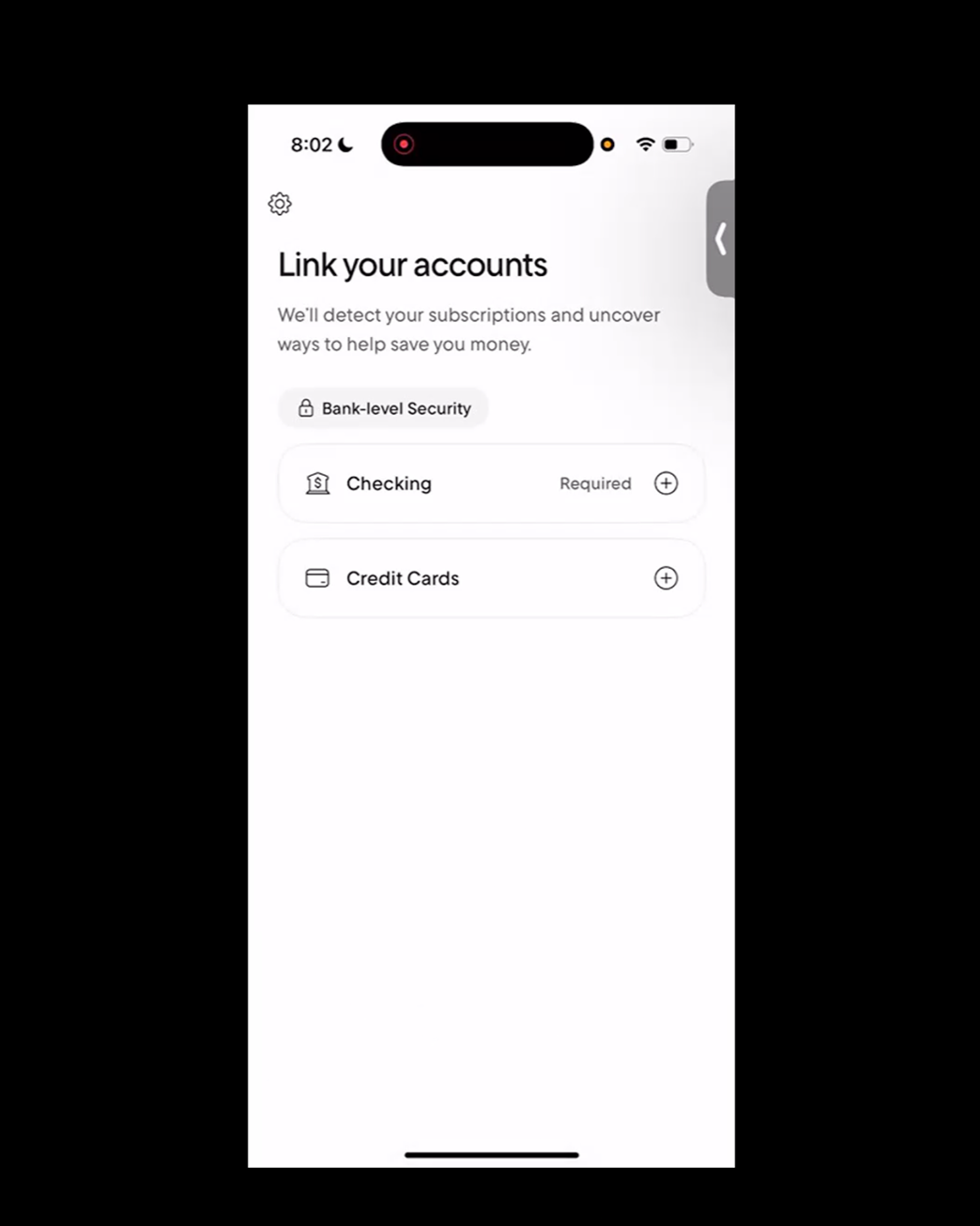

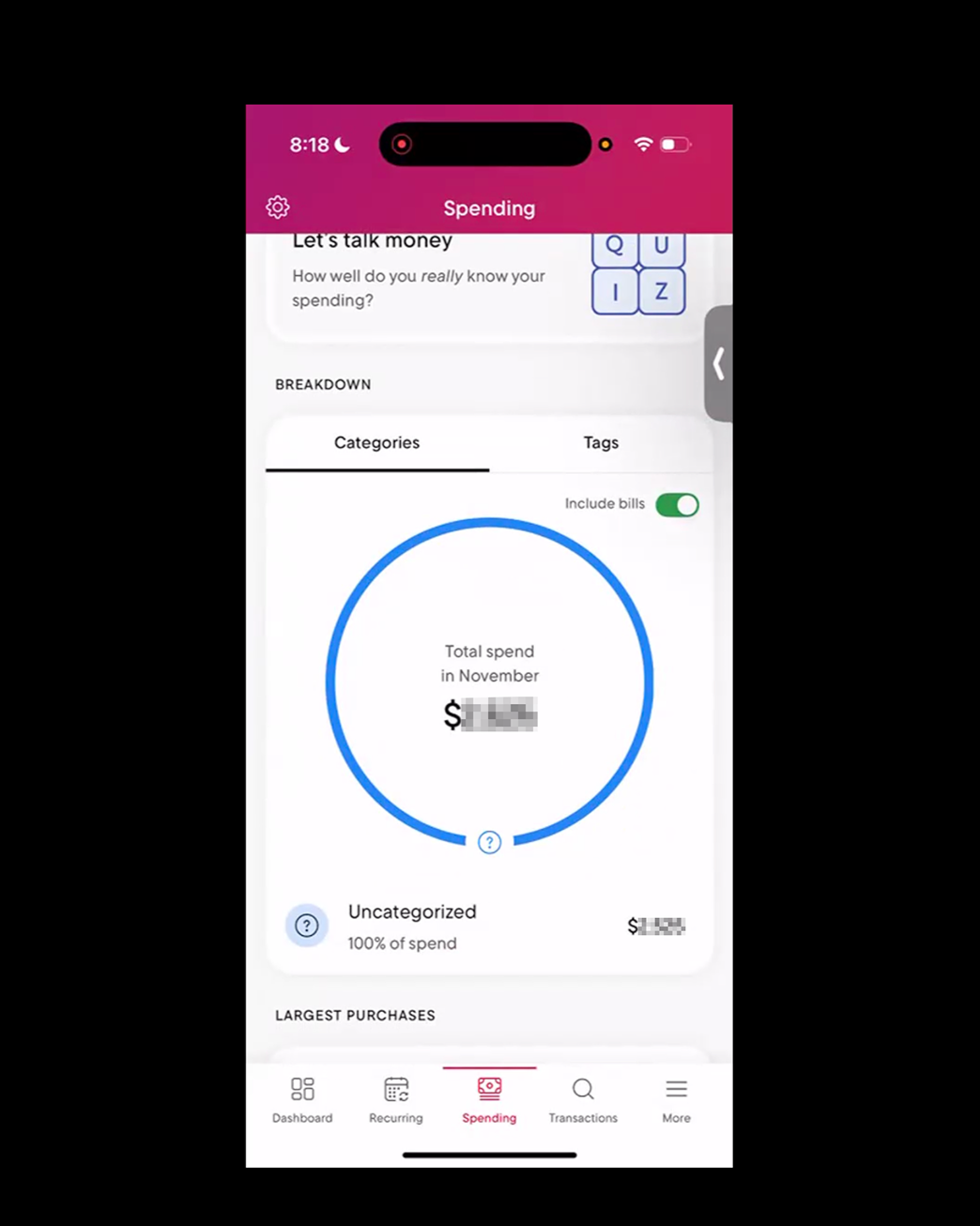

Incomplete Data

Spending data was incorrect because the user’s primary credit card wasn’t linked during setup. This gave the user an incomplete picture of their spending/budgeting habits.

“This is the part where I get a little nervous because I don't really like to give all of my [bank] logins. Do I have to go through this part of the onboarding process?”

Given that our user experienced legitimate concerns around Plaid authentication and the dark patterns related to subscribing, we saw an opportunity to establish credibility and trust with our app’s onboarding experience.

Design Direction

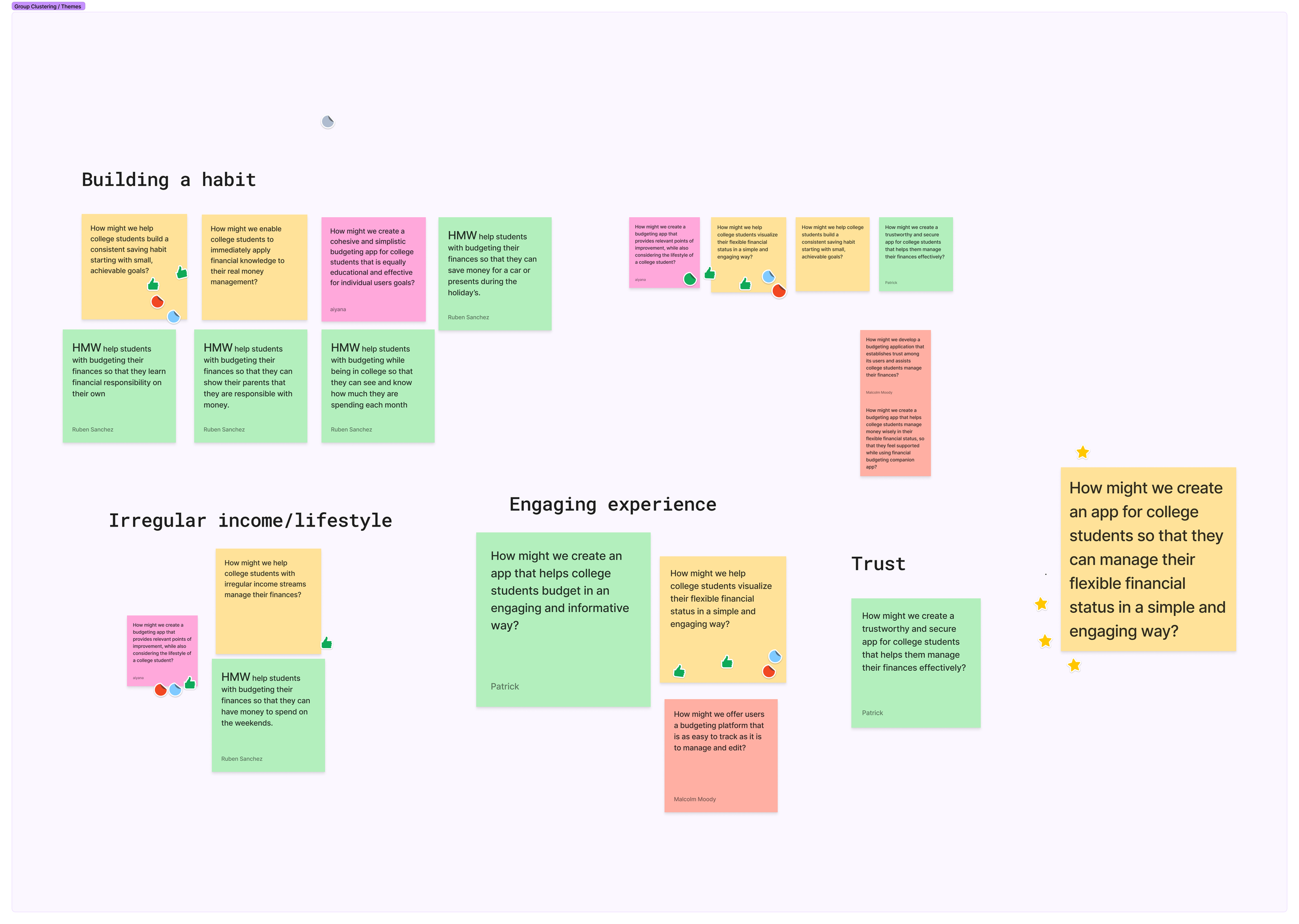

Our team synthesized research findings into a guiding question:

HMW Statement: How might we create an app for college students so that they can manage their flexible financial status in a simple and engaging way?

The initial rounds of research and discovery sessions made my focus for this project abundantly clear: Design an onboarding experience that addresses security concerns head-on by transforming the Plaid connection from a friction point into a trust-building moment.

Designing the Onboarding Flow

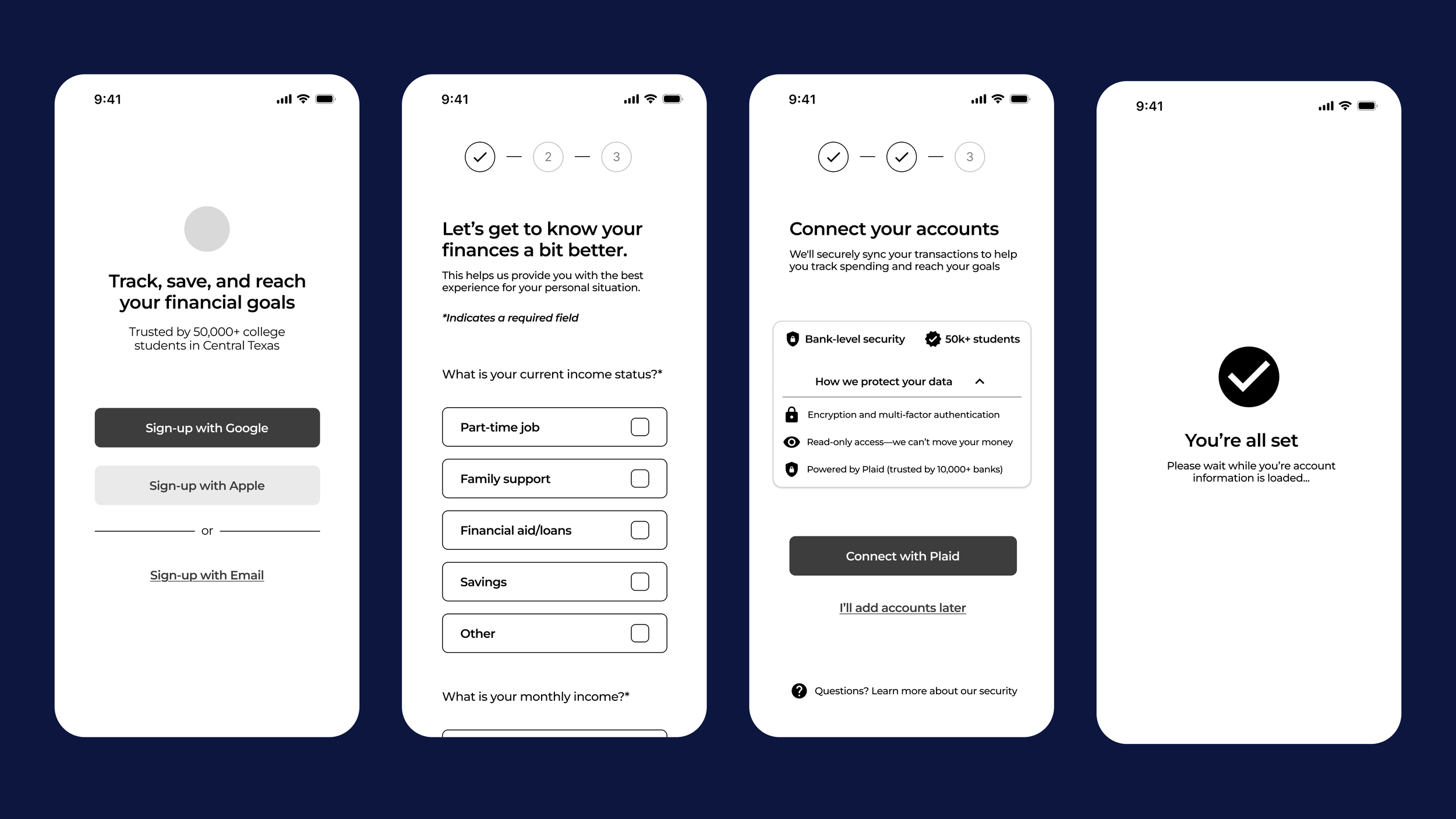

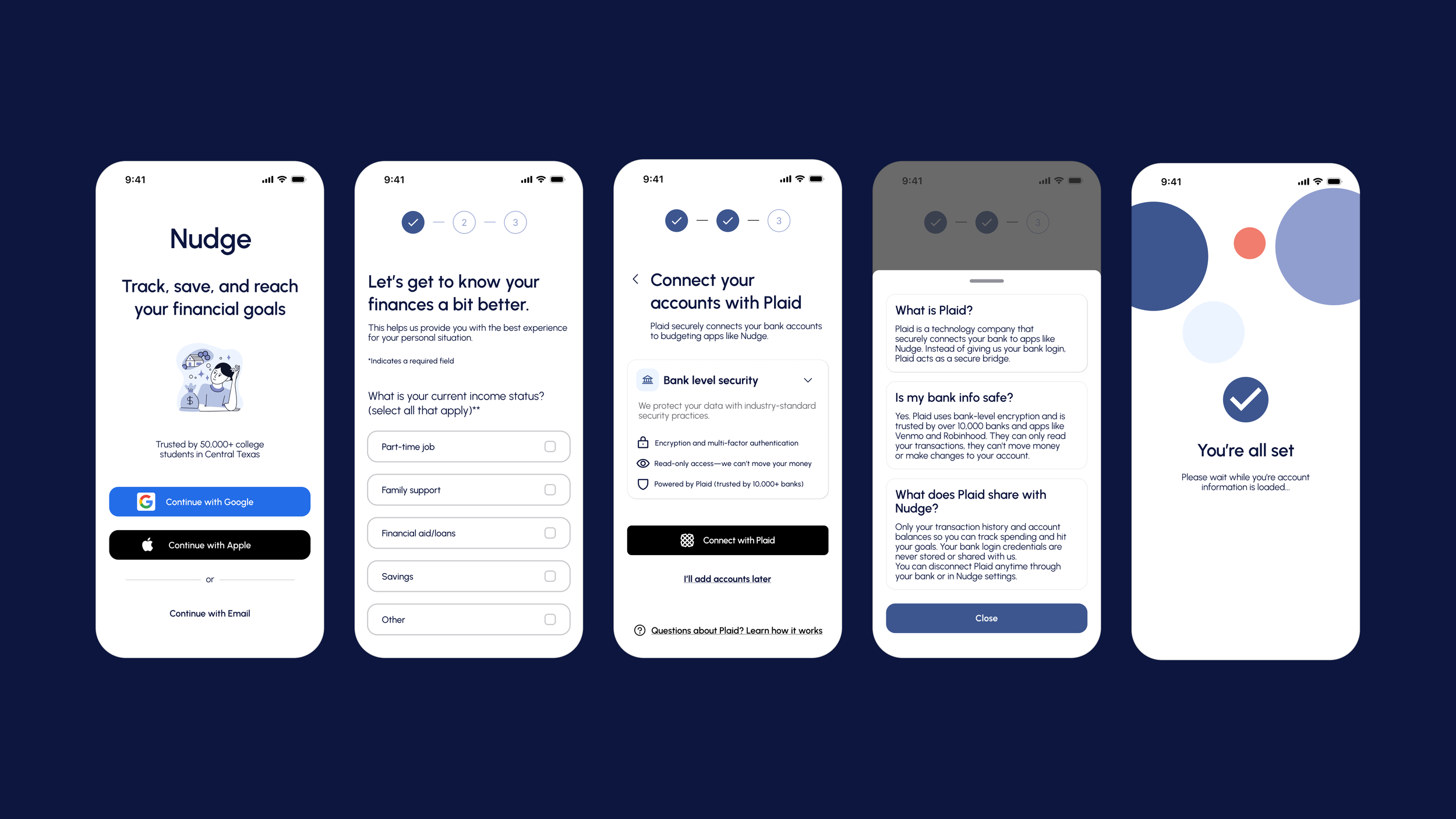

After identifying security anxiety as the critical barrier, I designed an onboarding experience with the overarching strategy of building user trust at every step, not just at the Plaid connection moment. My approach centered on four trust-building decisions:

Familiar Authentication First - Leading with Google and Apple sign-in reduces initial friction as users trust these platforms and already understand how they work.

Keep It Brief - A streamlined 3-step flow respects users' time and reduces cognitive load. Every additional step is an opportunity to lose trust.

Friendly, Human UX Writing - Approachable language makes financial management feel less intimidating, especially for college students new to budgeting apps.

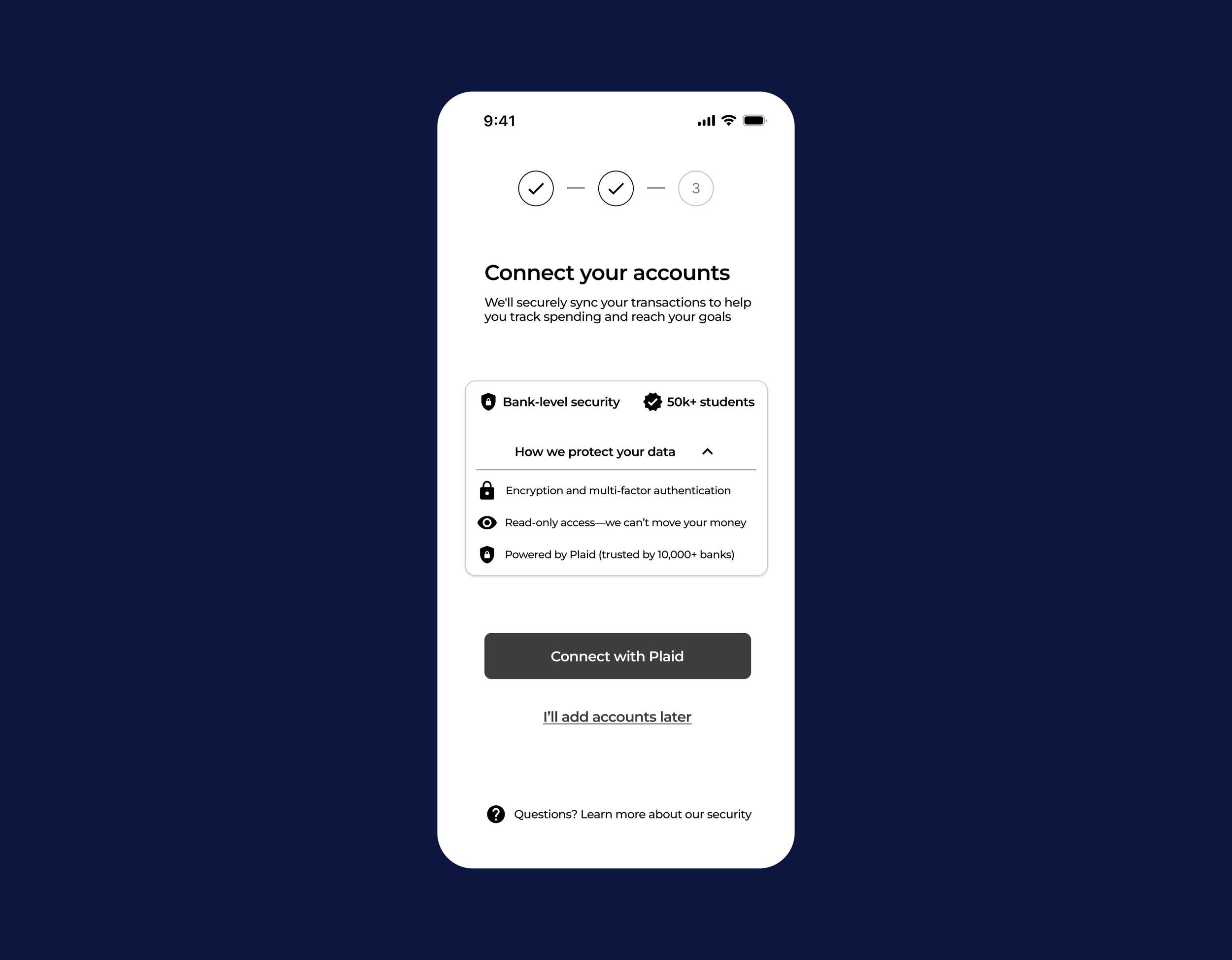

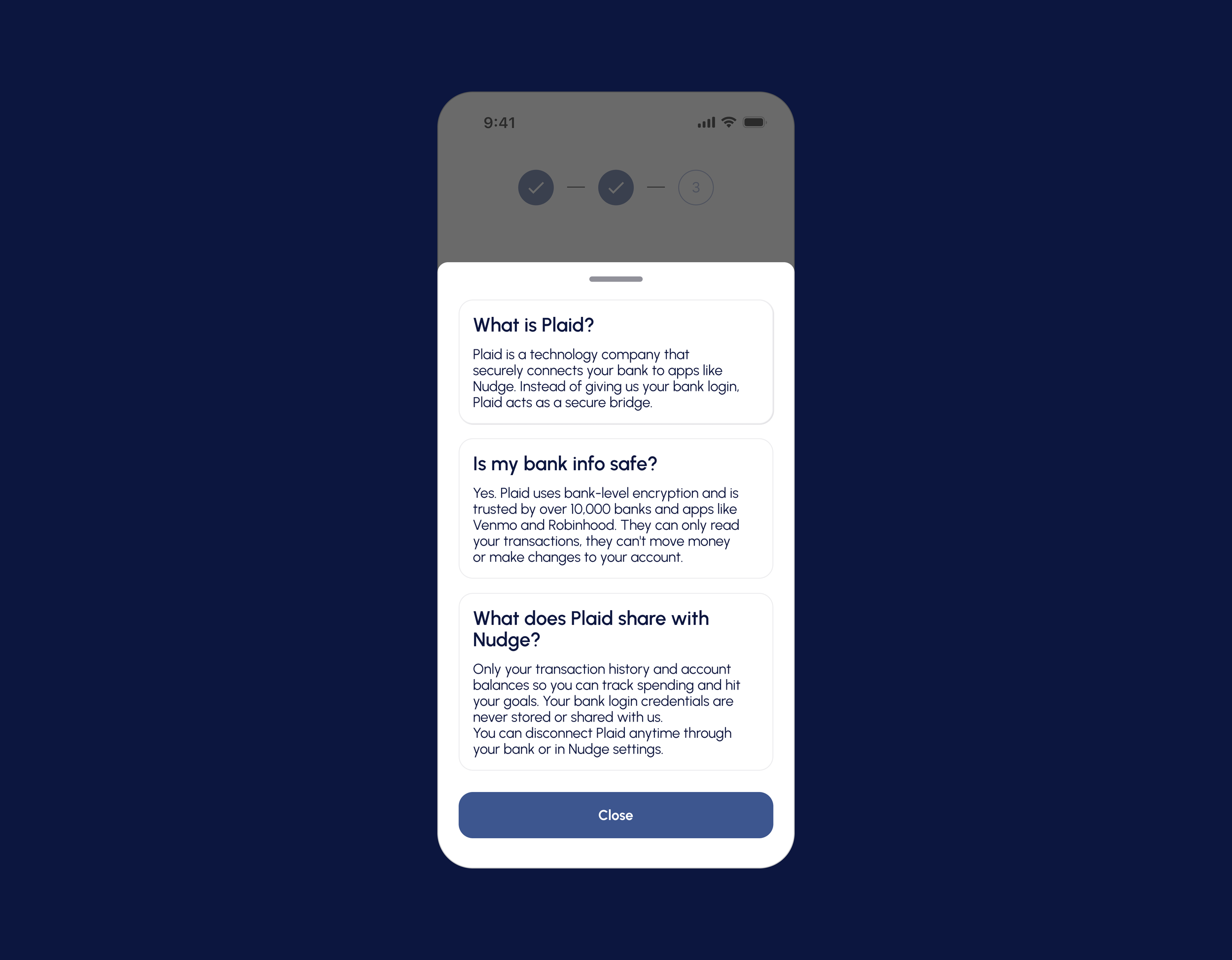

Transparent Education About Data - Before asking users to connect accounts, clearly explain what Plaid is, how Nudge uses it, and how their data will be managed.

This process involved multiple design iterations based on team critique and usability testing to refine this trust-building approach.

Initial Design: Early Explorations

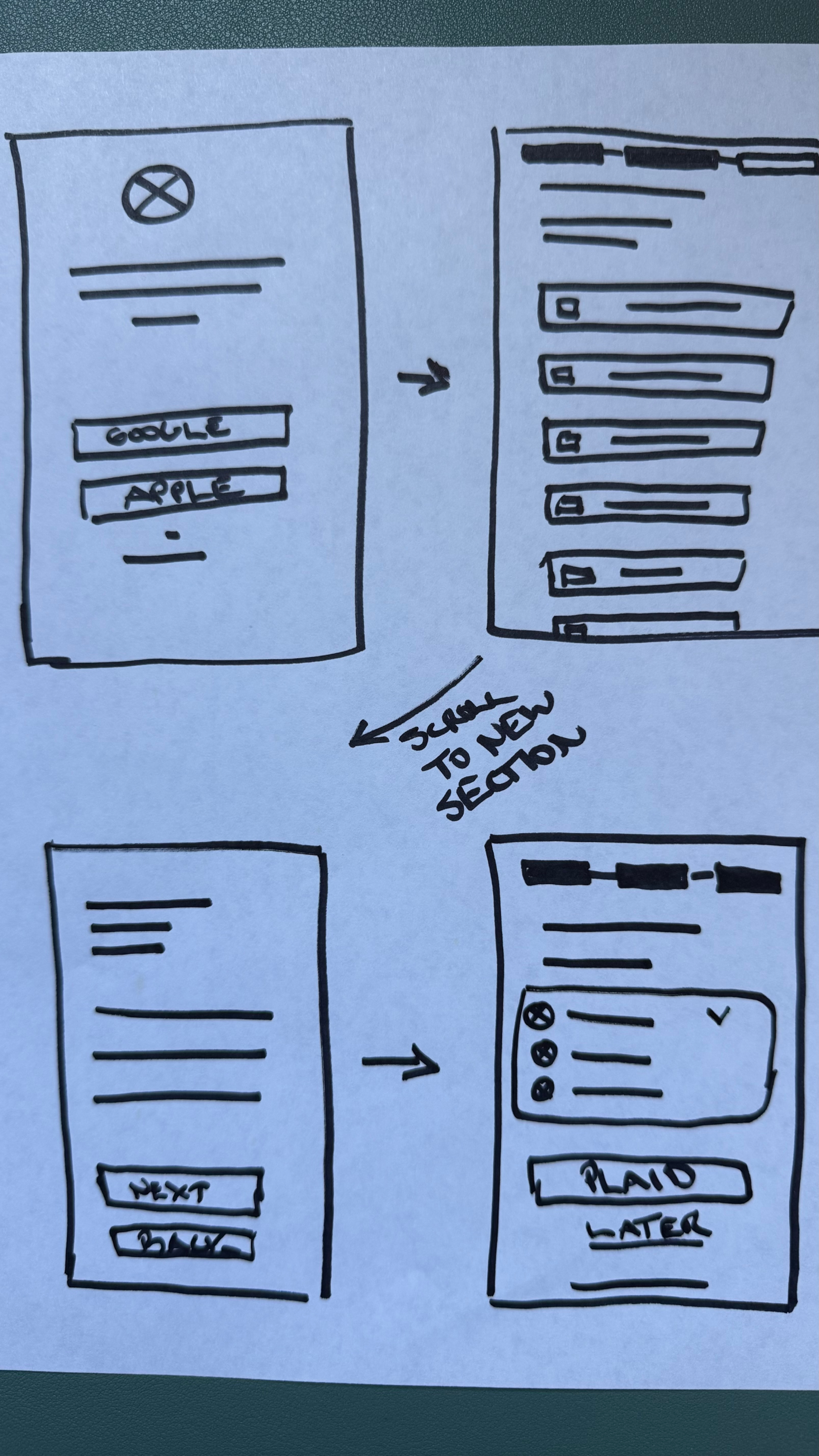

After establishing my design principles, I created initial wireframes to map out the onboarding journey. My primary goals were to introduce users to Nudge's value proposition, collect essential financial information, and address Plaid concerns before asking users to connect their accounts.

The initial flow consisted of:

Welcome screen with value proposition and authentication options

Profile questions to understand income sources and financial goals

Plaid connection screen with basic security messaging

Success confirmation

Refinement & Testing

The team provided valuable feedback during our critique session which helped to provide further direction as we moved into high fidelity designs and usability testing.

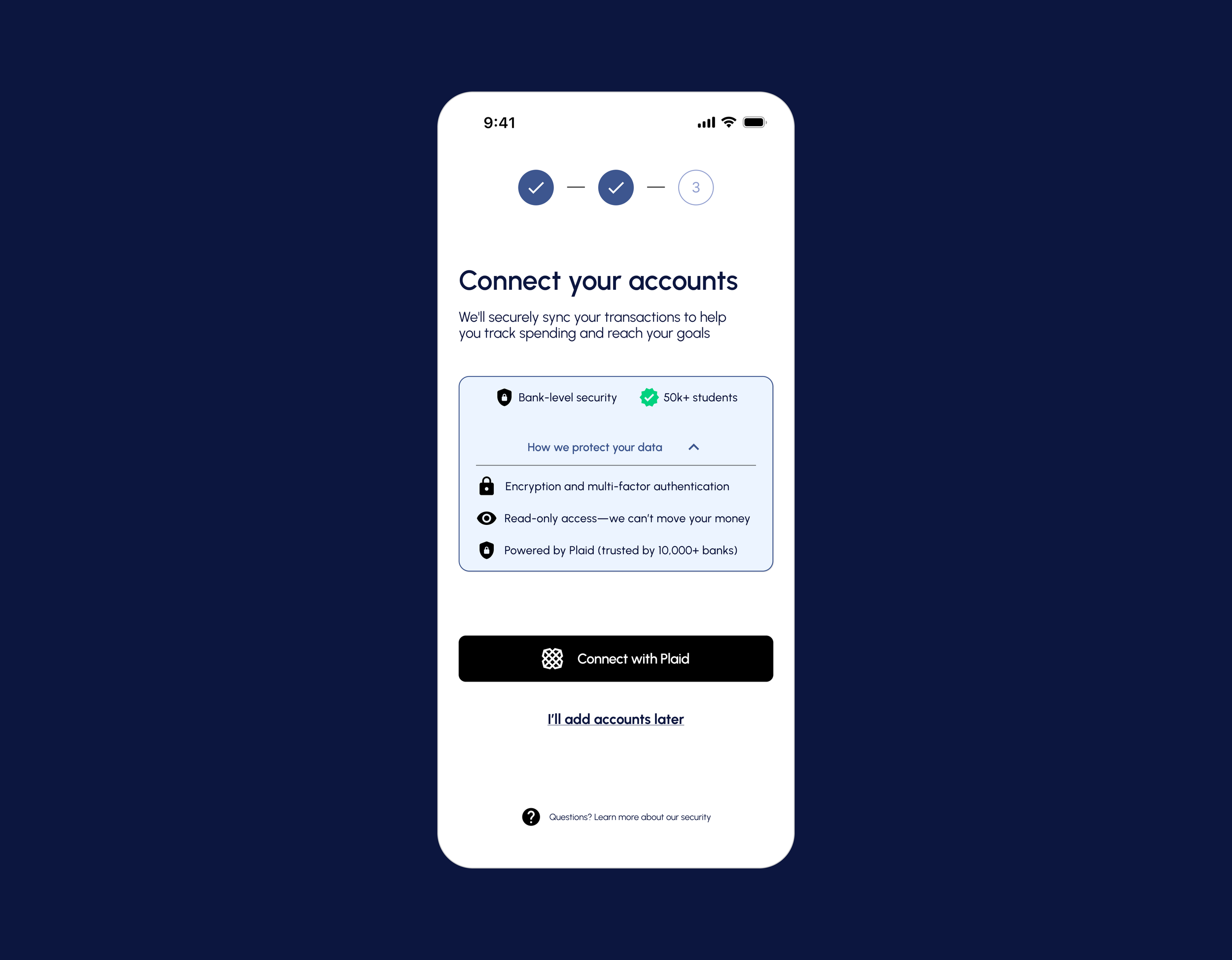

Specifically related to onboarding, these included adjusting layout of radio buttons/checkboxes to the left-hand side of the screen rather than the right, improving hierarchy in the form, and adding a visible escape hatch via a back button on the Plaid integration page.

Outside of these recommendations, we tested our prototype with real college students and received valuable insights, particularly related to Plaid in the onboarding experience.

Users in this round of testing indicated that they didn’t know what Plaid was and wanted more information around this integration, or they were generally confused about it.

“I don't know what Plaid is. More explanation would be nice. So I'll click the ‘I’ll add accounts later’ button.”

Final Design

After multiple rounds of refinement, the final onboarding design addresses security concerns through strategic trust-building at every step. The complete flow balances brevity, familiar authentication patterns, friendly UX writing, and transparent education about data security, transforming the Plaid connection from a potential barrier into a moment of user confidence.

Full Product Context and Reflections

My onboarding flow was one component of Nudge's full product. Each team member designed a core section: dashboard, budgeting, credit tracking, and missions, all working together to help college students build financial confidence.

Key Learnings:

Trust-building in fintech requires proactive education, not just security features. Users need to understand unfamiliar services like Plaid before being asked to commit.

Collaborative design challenges you to balance individual ownership with team cohesion. This project taught me how to advocate for my design decisions while staying open to feedback.